The from-the-ground-up nature of the DtF market’s rapid development has seemingly taken a lot of the bigger textile printer suppliers by surprise. Michael Walker sat down with Gary Weyman, EMEA regional business leader at DuPont to get the ink manufacturer’s view, as it unveiled its own DtF inks at ITMA.

In most print sectors, it’s usually the big equipment manufacturers who lead, developing complex products to address perceived markets needs, and sometimes to attempt to create new markets. The direct-to-film (DtF) sector turns this process on its head, however, with a host of smaller players at the distributor or reseller level effectively building their own machines and finding the ink and film combinations that work for them, spawning a wide ‘do-it-yourself’ industry that has developed from the ground up.

Recent months have seen the introduction of DtF machines from some of the bigger manufacturers, typically those who already have a presence in the wide-format signage and display market, such as Roland DG, Inktec, Mimaki and Ricoh, as well as sideways moves via product adaptations from DtG manufacturers like Brother.

It’s now also attracting the attention of the big name ink manufacturers, who see an opportunity not only to sell into a booming market but to sell differently, in their own name and not under the cover of the usual OEM confidentiality agreements. DuPont is perhaps the first to publicly throw its hat into the ring with the introduction of its Artistri P1600 DtF inks, formally launched at ITMA.

‘The spread of DtF has caught everyone out, and got them thinking what can they do. The equipment is less important here and differentiation is difficult,’ comments DuPont’s Gary Weyman. He adds, ‘The overall direction is to turn DtF into an industrial process; we’re starting to hear brand demands for 30x 60° wash durability – only one year ago, the brands wouldn’t have heard of DtF.’

Consistency is key

Mr Weyman says that consistency in DtF is becoming a key requirement, which means that users will need reliable inks to achieve this, especially those operating across bigger sites with multiple printers, or even operations across multiple sites or countries.

He confirms that DuPont has worked with OEMs for DtG inks, and developed formulations specifically for them, where the machines were known and consistent. However, in DtF, the OEMs haven’t been developing the market in the same way, he reports. ‘We estimate that there are a few thousand DtF installations in Europe, with about 1500 in Turkey, for example, and OEM sales represent under 10% of this.’

DuPont’s Gary Weyman sees DtF as a potential tipping point in textile printing

DuPont sees this as a potential turning point. ‘The opportunity is the installed base; distributors or ‘integrators’ as they’re known are actively engaging and can get closer to the user. Brands, in sports and retail are opening up [to the possibilities of the technology], saying ‘the freedom DtF is giving us is refreshing’.’

Mr Weyman says that some big DtG users are switching off their machines and replacing them with DtF units at one-tenth of the cost. The DtG counter-argument is the hand feel, which is usually inferior with DtF because of the hot melt fixing process, though finishing techniques are still evolving. Mr Weyman says DuPont is trying to talk to the film producers but it’s not yet clear if a consensus will be reached; he says DuPont is looking for testing and conformance but is stopping short of endorsement.

In terms of printheads, the Epson i3200 seems to be a clear favourite for DtF applications, and prior to Epson’s decision to sell its printheads directly to OEMs, many have been ‘harvested’ from Epson’s own machines for use in DtF systems. DuPont has developed low viscosity ink for use with this and other Epson printheads, and he also notes that a number of distributors/integrators are aiming to become their own OEMs.

Pigment to the fore

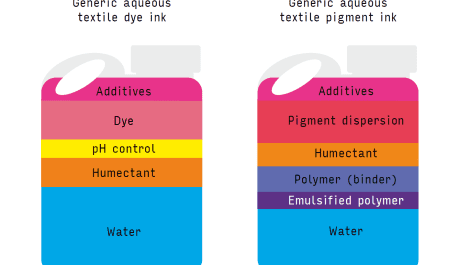

The rapid growth of interest in pigment inks – led in part by the DtF boom – means that DuPont has taken the decision to move away from producing reactive, dye disperse and acid ink types. The company reached an agreement in April 2023 with Indian manufacturer Colourtex Industries, which will produce, distribute and sell the reactive and direct disperse inks in the Artistri line under licence. DuPont will cease production of acid inks at the end of 2023.

‘There is a clear focus on pigment inks, we see a very strong future for these because of the reduced water use,’ says Mr Weyman, citing a Turkish user who is taking its reactive ink printing equipment offline in order to switch to pigment. ‘There is a push from users for ecological reasons and a seriousness about sustainability that has been going on for around two years. Our commitment to pigment is extremely strong.’ In evidence of this, the company increased its manufacturing capacity at Fort Madison, Iowa, USA, in late 2022 and there has also been investment in China to support that market directly.

Mr Weyman notes that pigment inks lend themselves to commercial and packaging print too, with ‘a lot’ in development, sample books already produced and announcements possible later in 2023. He also praises the company’s agility in bring the Artistri P1600 DtF inks to market as ‘amazing’. Sales have already begun, he says. Although the inks were officially launched at ITMA, they were also demonstrated by Resolute DTF at Printwear & Promotion Live in the UK in February.

It looks like the DtF revolution is not only changing how people print to fabric, but how the people who make the equipment and consumables sell to them too. Truly a disruptive technology.