The world market for dye sublimation print is returning to a promising growth trajectory, according to the latest insight from paper, print and packaging industries consultancy Smithers and provided exclusively to Digital Textile Printer.

Exclusive data from its new report The Future of Dye Sublimation Printing to 2027 show that in 2022 the world market reached a projected €8.8 billion, inclusive of printing to hard surfaces, which accounted for some 44% of that figure. This is indicative of a wider recovery after two years of major market disruption caused by the pandemic.

Covid-19 has created profound shifts in the landscape for many print products. Overall packaging and label work continues to enjoy positive, largely organic growth. Publications print, newspapers and magazines in particular, have lost sales that will not be recovered. Volumes are now returning in print advertising and commercial work, but future growth is sluggish.

For dye sublimation print, some of the post-pandemic changes are positive, especially the increasing use of web-based print commissioning, and the desire to reshore or localise textile supply chains. Smithers now forecasts the global dye-sub printing market will expand at a compound annual growth rate (CAGR) of 9.9% to reach €14.1 billion in 2027, at constant prices.

Garments

In 2022 total demand for dye-sub printing of apparel will be €3.78 billion. This has one of the strongest growth predications through to 2027; in that year garments/apparel will account for nearly 45% of global dye sublimation printing value.

Some clothing types, such as swimwear and athletic wear has long made heavy use of dye sublimation print to deliver colourfast moisture-resistant garments. The market has since, and continues, to diversify into less specialised apparel. At the top of the market several leading dye-sub manufacturers are even collaborating with big name fashion labels to print bespoke haute couture apparel.

Most apparel purchases stopped during Covid-19 as conventional retail outlets were shut and social distancing reduced the appetite for consumers to buy new clothing.

The dye-sub segments that are benefitting most are those that have embraced a fast-fashion production model. Pre-pandemic, the main attraction of this was improved order turnaround, low-cost customisation and reduced retailer stock holdings. With a marked increase in online apparel shopping, these factors have gained in importance, and have been joined by a new realisation of how fragile garment supply chains from existing low-labour cost areas in Asia can be. International shipping rates remained stubbornly high through 2021 and into 2022, making digital and dye-sub increasingly cost-competitive.

Furthermore inkjet printing is increasingly being positioned as a more planet-friendly alternative, with less wastage, water use and pollution – aligning to brand personas that embrace ‘ethical fashion.’

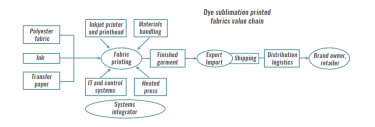

The dye-sub printed fabrics value chain (source: Smithers)

Home décor

A parallel segment that has also seen a benefit from an increase in web-based shopping is home décor. Locked down and unable to travel, many consumers have used the pandemic years to revitalise their home interiors. Dye-sub printed cushions, furniture, bed linen, wallpapers, decorative accent panels, wall hangings, carpets and flooring laminates reached a total market value of €422.1 million in 2022. While representing only about 5% of the contemporary market, household textiles are forecast to be the fastest growing market segment for 2022 – 2027.

Home décor is experiencing the same positive impact from the desire to reshore production, and in this segment too customisation is increasingly important. Recent trends in interior design have de-emphasised the use of wallpapers and other traditional media in mass-market applications, except as accent pieces and in high-end environments, creating new applications for bespoke dye printed elements.

Soft signage

Soft visual communications – flags, banners and other interior or exterior signage – are the main market for wide-format dye-sub printing. These were badly hit in the initial years of the pandemic as the vast majority of public events – concerts, sports matches and festivals, as well as industry trade shows – were cancelled. There was a corresponding drop in demand (-7.9%) for in the first year of the pandemic.

While dye sublimation is often used for its durability and improved colour fastness, especially in outdoor applications, such items are often specific to an event or promotional season. This short service life means that a rapid recovery in dye sublimation work has occurred as retailers and event organisers look to emerge from the Covid purdah.

With the noticeable exception of China, this move was largely completed by 2022 with dye-sub visual communications reaching a projected €556.2 million worldwide in that year. There is future positive growth forecast for the next five years. This has been moderated down somewhat however as many advertising budgets are now more focussed on electronic communications, and as the vast majority of such work was always printed locally there has been a limited benefit from reshoring trends.

John Nelson, Smithers

John Nelson is an editor at Smithers. The market outlook for dye sublimation print in garments, home décor, displays, technical textiles and rigid goods is examined and quantified in the new Smithers study The Future of Dye Sublimation Printing to 2027. The report is available from smithers.com